Outstanding Info About How To Keep Track Of Mileage For Taxes

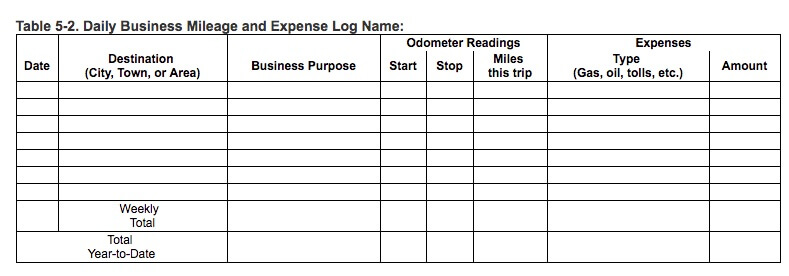

The standard mileage deduction requires only that you maintain a log of qualifying mileage driven.

How to keep track of mileage for taxes. Keep your log on paper and pay with your time (for beginners only!) keep your log with free or. The irs requires records but it doesn't dictate how you keep them. The current crop of mileage apps eliminate most of the time spent tracking, logging, calculating, reporting, and approving employee business.

How do you keep a mileage log for taxes? If you allow quickbooks to use your location, it will automatically put any trips that you take in the log, and then you have the option of marking each trip as business or personal. How does mileage work on taxes?

Keeping track of mileage records for tax reimbursement is tedious. Download mileiq to start tracking your drives automatic, accurate. Track mileage for the tax year with a tracking app (like everlance).

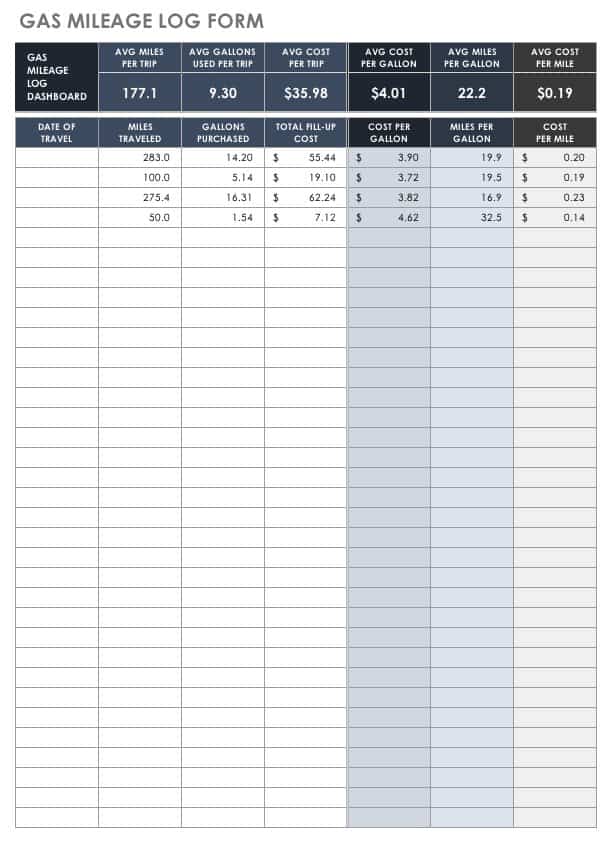

What’s the best way to keep track of mileage for taxes in 2022? In 2021, the standard rate multiplies the total number of. How to keep track of gas mileage for taxes:

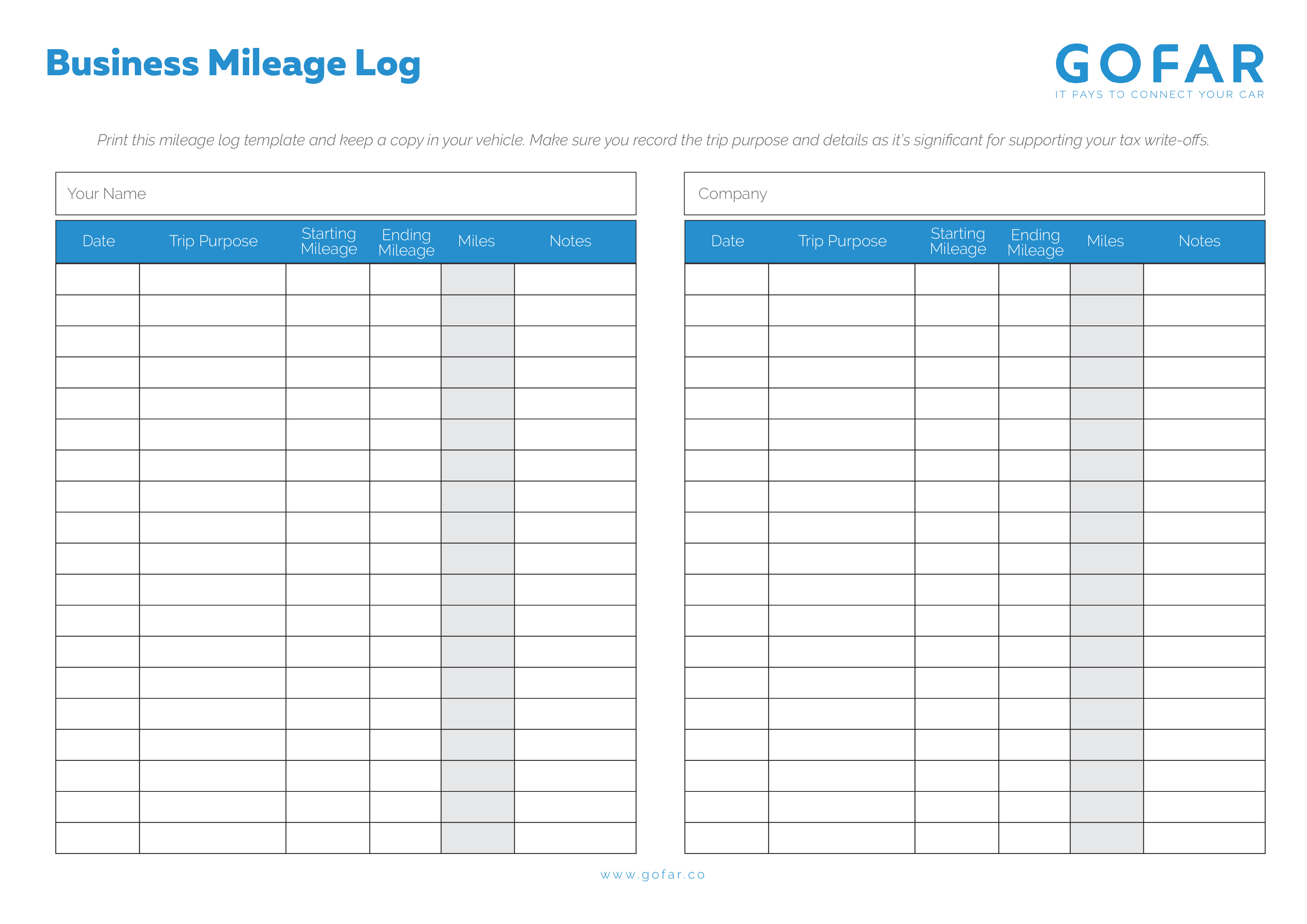

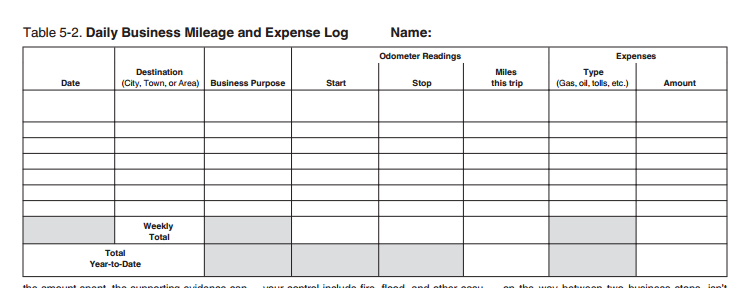

By employing mileage expense tracking, a company can get the following 7 benefits: The best way to keep track of mileage for taxes is to have a contemporaneous mileage log. There is no specific irs mileage log template.

That means you must record your miles soon after they occurred. For all transportation, the irs asks that you log the following: Thus you can keep a simple mileage.

![Forgot To Track Your Miles? We've Got You Covered [2020 Taxes]](https://blog.withpara.com/content/images/2021/04/abcdefg.png)